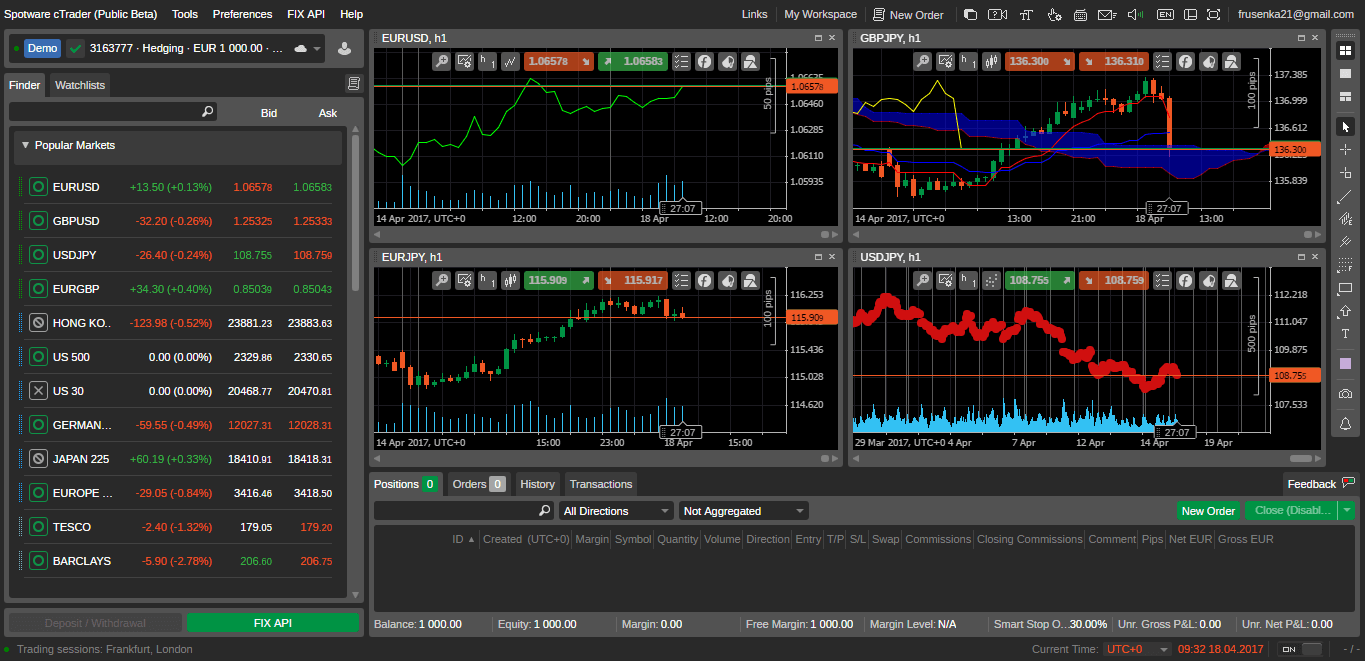

Chart designs will likely be good at forecasting rate motions, but their accuracy improves whenever along with almost every other products such as regularity, impetus signs, and you may principles. Harmonic habits is complex graph structures centered on Fibonacci ratios, such as 0.618 otherwise step 1.272, to help you anticipate price moves. The brand new breakout over the resistance height designed by the rounding bottom verifies the brand new pattern reversal. And these signs, traders also can play with Currency Power Symptoms to suit graph habits. These symptoms render an introduction to the fresh cousin energy of various currencies, and that is such used for traders that are taking a look at money pairs.

Translation of one’s glass and deal with graph pattern

Effective graph models accommodate highest-prize deals when carried out that have confirmation and you will best chance management. The brand new Twice Bottom trend is actually most reliable if it comes after a good extreme downtrend, because it signals the synthesis of a powerful assistance region. Organization investors monitor the newest pattern for accumulation levels, where highest to purchase focus inhibits then rates declines.

These immedchain.com types of patterns signify periods the spot where the bulls otherwise carries features work at from steam. The brand new dependent trend have a tendency to pause, up coming head inside a different advice since the the newest time emerges regarding the other side (bull or happen). If the price holiday breaks over the opposition line, normally a buying rule, since it verifies a bullish breakout. A good sell signal takes place when the rates falls below the support line, proving an excellent bearish breakout. A purchase code are brought about in the event the price holiday breaks over the resistance peak with additional to purchase regularity.

Double Greatest and you can Double Base Habits

That it development implies a possible move inside the business sentiment, to your bears wearing manage as well as the uptrend potentially reversing. Rosenbloom’s study inside it examining historic inventory study around the individuals areas so you can assess the performance and you may reliability of numerous candlestick models, like the upside down hammer. Depending on the study titled “Encyclopaedia away from Candlestick Charts” because of the Thomas Letter. Bulkowski, the brand new optimistic harami development provides a survival rates of about 54% inside the predicting industry reversals. Candlestick charts were used for over century, while it began with 18th millennium Japanese grain trade. The first identified have fun with are because of the well known Japanese grain trader Munehisa Homma regarding the 1700s.

It provides a definite development reversal, permitting buyers select to buy potential. The fresh well-laid out design makes exposure management easier, making it possible for precise stop-losses, beneath the service city, and you may target location, proportional to the level of the pattern. The new Multiple Best trend is extremely proficient at areas with experienced expanded uptrends. The newest trend indicators one to organization buyers spreading their holdings before a good big refuse. An intense dysfunction with growing volume enhances the likelihood of a great sustained downtrend.

Meaning you can use TradeStation for your broker and then make deals right from a good TradingView graph. In this graph, a good hammer candlestick is watched and you will post and this, the fresh stock attained positive energy. George Soros is well known for his audacious trade projects and you may profound influence on the new financial globe. The guy made over $step 1 billion overnight away from their very better-recognized exchange, “damaging the Financial of England.” Investors is far more accurately welcome future market moves and you can work correctly by knowledge such designs. In this post, we’ll discuss the big ten common exchange designs that may improve your tips.

Explore Numerous Timeframes

As the a trader, you should come across for example breakouts then put longs or shorts with regards to the sort of banner. It occurs if the rate variations lower levels and higher downs, that also variations a variety of “megaphone”. Right here, the consequence is a viable trend reverse to your upside, so inflation are to be questioned. A dying get across, as well, will be interpreted while the a good offer code because it suggests a good down development.

The new pattern are then verified from the volume verification, while the increasing volume in the breakdown reinforces the likelihood of a sustained reverse. The brand new development grows because the sellers slowly remove energy when you are customers start gaining manage. A verified breakout happens when rate motions decisively beyond opposition top to help you a powerful rally. Buyers estimate the potential speed address because of the computing the newest wedge’s level and applying it from the breakout part. A major benefit of the brand new trend is being able to render prepared exchange configurations that have direct entryway and you can get off points. Investors place stop-loss orders above the banner to deal with exposure with all the flagpole’s height to endeavor possible rates plans.

Establish Wider industry framework

People must wait for incorrect breakouts, where rates briefly motions beyond your pennant ahead of reversing. Extra technical confirmation enhances reliability of your own Pennant Models. The brand new habits is actually effective graph models people use to make the most of trend momentum.